In the 2019 business year, earnings before interest and taxes (EBIT) came to some 3 billion euros. This puts the estimated EBIT margin at just under 4 percent. Result was affected by the downturn in automotive production, particularly in the key Chinese and Indian markets, the further reduction in the share of diesel engines in cars, high restructuring costs (particularly in the mobility segment), and increasing upfront investments in projects of future importance. “The current year remains challenging for many companies, especially in the automotive industry and mechanical engineering segment – and hence also for Bosch,” said Prof. Stefan Asenkerschbaumer, CFO and deputy chairman of the Bosch board of management. “Nonetheless, in the sectors and regions that are important for us, we want to grow more strongly than the markets once again in 2020,” he added, cautioning that Bosch will have to continue to work rigorously on its profitability and adjust its manufacturing capacity.

Mobility of the future: the challenges of change

Bosch has a clear picture of the future of mobility and of how to make a success of the move to alternatives. “Tomorrow’s mobility will be not only electrified and automated, but also connected and personalized,” Denner said, adding that because of its diverse portfolio, Bosch is better prepared for the various scenarios and developments than almost any other company. However, he warned that the road to the mobility of the future presents the automotive industry with some major challenges. First, irrational arguments about the car have stifled any level-headed, nuanced debate about road traffic. Second, the industry needs more time to manage the transition. As Denner emphasized: “Particularly when it comes to jobs, a process as fundamental as the transition to electromobility can’t be achieved overnight.” Third, the economic situation is exacerbating the need for structural change in the industry. Bosch expects global automotive production to shrink in 2020 for the third year in a row. This year, the company is forecasting a further decline of 2.6 percent to some 89 million vehicles worldwide – almost 10 million units less than in 2017. Bosch is expecting this level to remain constant over the next few years, and does not anticipate any increase in global automotive production before 2025.

The company intends to adapt its cost structures and workforce to the dramatic changes and overcapacity in the industry in the most socially acceptable way possible. Denner: “We have already reached agreements on this subject with our social partners at major locations such as Bamberg, Schwieberdingen, and Stuttgart-Feuerbach.” The goal is to adopt an approach that preserves individual growth opportunities at the locations and retains as many associates, and their skills, as possible.

Mobility of the future: business opportunities for Bosch

“The move to alternative mobility will not be the end of mobility – and certainly not the end of the car,” Denner said, adding that Bosch is still well-positioned in its quest to be a leading provider of mobility solutions. He went on: “The fundamental upheaval in the automotive industry holds great opportunities for Bosch.” This includes growing demand for mobility in the future. According to the International Transport Forum (ITF), personal mobility will increase by almost 50 percent worldwide between 2015 and 2030. “For the foreseeable future, the car will remain the number one means of transport – and has excellent prospects of becoming an even safer, more convenient, and more eco-friendly means of transport,” Denner said. New technologies such as the internet of things (IoT), artificial intelligence (AI), and the fuel cell will also further advance the move to alternative mobility. As an innovation leader, Bosch will benefit from its early entry into these areas of development. Furthermore, new automakers in the electromobility market increasingly require complete solutions rather than components. He continued: “For us as a full-service provider, more systems business means sales potential running into the billions.” In the future, Bosch will also benefit from the trend toward more electronics and software: The company estimates that the market for software-intensive electronics systems will grow by 20 percent annually between now and 2030. Bosch invests some 3.7 billion euros annually in software development and currently employs 30,000 software engineers.

Upskilling the workforce: AI training program for 20,000 associates

For Denner, a qualified workforce is a strategic success factor for mastering current and future challenges. “Bosch sees itself as a learning organization in which learning is integrated into day-to-day work,” he said. In addition to its regular investments in upskilling its workforce, Bosch is launching a new AI training program for nearly 20,000 associates. It includes training formats at three different levels for managers, engineers, and AI developers and includes guidelines for using AI responsibly.

Developing business: some 3 billion euros for growth areas

Bosch intends to expand its existing business and open up new areas of business. “We want to do this by making substantial up-front investments in future technologies,” Denner said. “In the period from 2013 to 2020, Bosch will have invested a total of some 3 billion euros in completely new growth areas.” This year, Bosch will invest 500 million euros in electromobility alone, including fuel cells. It will spend more than 600 million euros on automated driving and another 100 million euros on connected mobility solutions. Moreover, since 2015 Bosch has invested 600 million euros in expanding its activities relating to the internet of things. These include the new Bosch IoT Campus in Berlin and the expansion of the company’s connected industry business.

Exploiting competitive advantages: technology leadership and neutrality

By moving into new technologies, Bosch is securing important sales potential in markets worth billions. For instance, before safe automated driving can become a reality, a third sensor principle is needed in addition to camera and radar. This is why Bosch is completing its sensor portfolio and starting production of long-range lidar sensors. As Denner explained, “This bridges the sensor gap and makes automated driving a viable possibility.” The laser-based distance measurement tool can reliably detect even non-metallic objects at a great distance, such as rocks on the road. This means there is plenty of time to initiate driving maneuvers such as braking or swerving.

Bosch is also driving forward the commercialization of the fuel-cell powertrain: it is developing the powertrain’s core component, the stack, together with Powercell and plans to launch it in 2022. The company is also continuing to invest in highly efficient combustion engines. According to Bosch market research, two out of every three newly registered vehicles in 2030 will still run on diesel or gasoline, with or without a hybrid option. He continued: “The path to emissions-free mobility must be technology-neutral. This is the only way to make mobility affordable for the general public.” The solution is a powertrain mix of highly efficient combustion engines and state-of-the art electric motors. In addition, Denner is committed to the use of renewable synthetic fuels: “Legacy vehicles already on the road will also have to play their part in cutting CO2 emissions. Renewable synthetic fuels can make the combustion process carbon-neutral.” To this end, Denner calls on policymakers to put the framework in place for a technology-neutral and hence innovation-friendly environment. This is a necessary step if the move to alternative mobility is to be a success, maintaining existing jobs and creating new ones, Denner said.

Beyond the mobility of the future: developing new technologies

Bosch wants to go beyond the mobility of the future to develop new technologies and promote climate action. In doing so, the company wants to maintain a balance between the economy, the environment, and corporate social responsibility. On its path to becoming a leading IoT company, Bosch is relying on AI. “We want to use industrial AI to make our products function as assistants for our customers – which we hope will make us one of the global leaders in this domain,” Denner said. To this end, Bosch is investing 100 million euros in its AI campus in Tübingen alone. The company is also driving forward its own climate action initiatives: At the end of 2019, Bosch achieved carbon neutrality for all its locations in Germany; by the end of 2020, the same will be true of all Bosch locations worldwide. “Climate action and energy efficiency offer Bosch further business opportunities,” Denner said. In Germany alone, up to 45 percent of electricity will come from renewable sources by 2025 (source: BMWi). “This is why we will be investing 100 million euros in growing our heat pump business over the next few years.”

Business developments in 2019 by business sector

Business developments in 2019 were similar across Bosch’s various operating units. In Mobility Solutions, which generates the highest share of sales, growth outstripped global automotive production. At 47 billion euros, sales came in at the previous year’s level. In nominal terms, this represents a decrease of 0.1 percent, or 1.5 percent after adjusting for exchange-rate effects. In the Consumer Goods business sector, sales amounted to 17.8 billion euros. This represents a decrease of 0.2 percent, or 0.6 percent after adjusting for exchange-rate effects. The BSH Hausgeräte and Bosch Power Tools divisions held their own in a strong competitive environment, with Bosch Power Tools performing above average. The Industrial Technology business sector achieved sales of 7.4 billion euros, or 0.1 percent more than in the previous year, despite a marked decline of over 4 percent in orders in the mechanical engineering sector. Adjusted for exchange-rate effects, sales fell 1.2 percent. The Energy and Building Technology business sector achieved growth of 1.5 percent, generating sales of 5.6 billion euros. This is an increase of 0.8 percent after adjusting for exchange-rate effects.

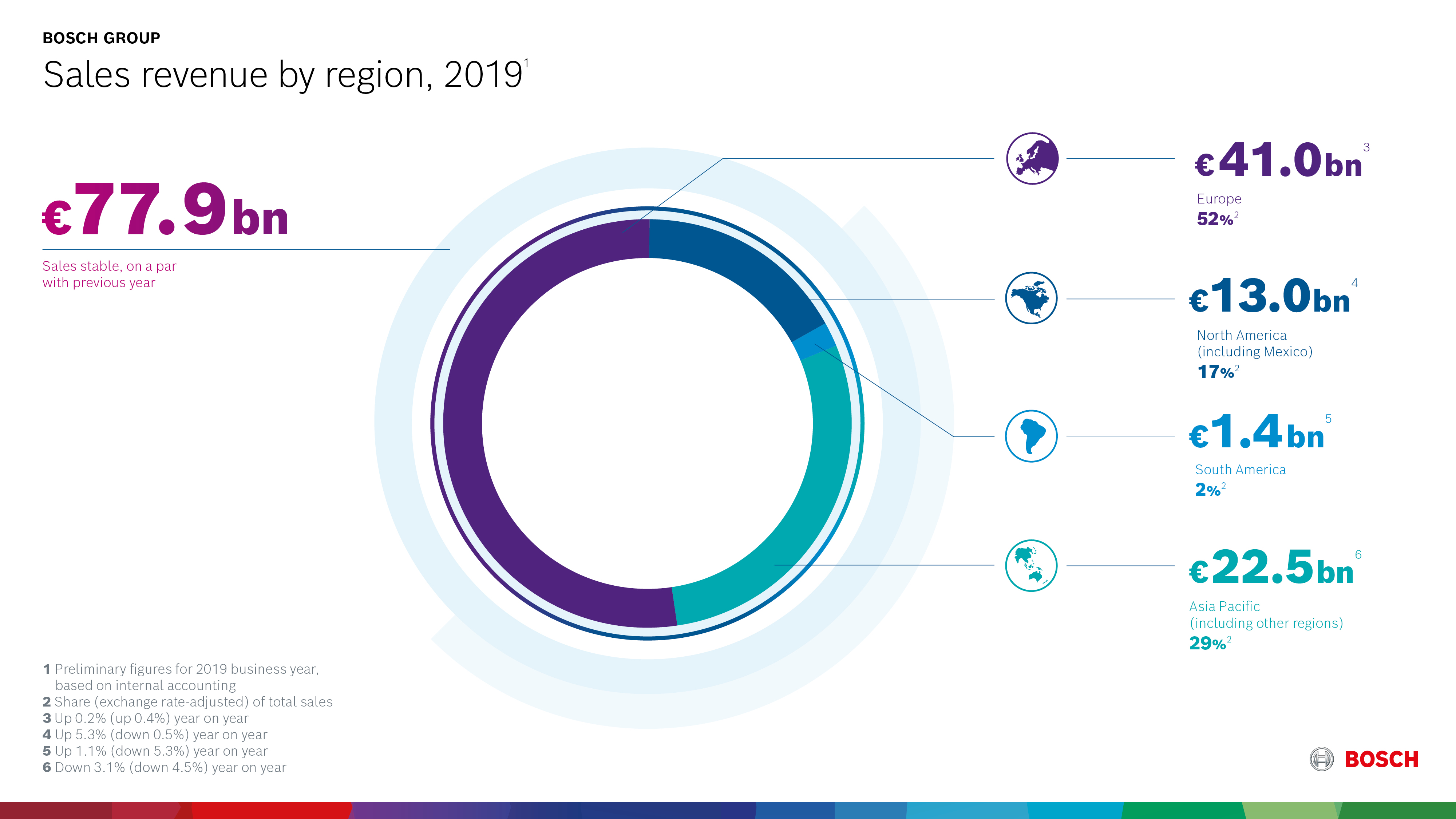

Business developments in 2019 by region

In Europe, Bosch’s businesses saw stable development. At 41 billion euros, sales were on a par with the previous year. In North America, sales grew by 5.3 percent to 13 billion euros. Adjusted for exchange-rate effects, this is a decrease of 0.5 percent. In South America, sales rose to 1.4 billion euros. This equates to growth of 1.1 percent, or 5.3 percent after adjusting for exchange-rate effects. In Asia Pacific, business development was negative overall. Sales declined by 3.1 percent to 22.5 billion euros, a drop of 4.5 percent after adjusting for exchange-rate effects. Sales performance was particularly affected by the slump in the automotive markets of China and India. Japan and Southeast Asia, on the other hand, developed positively.

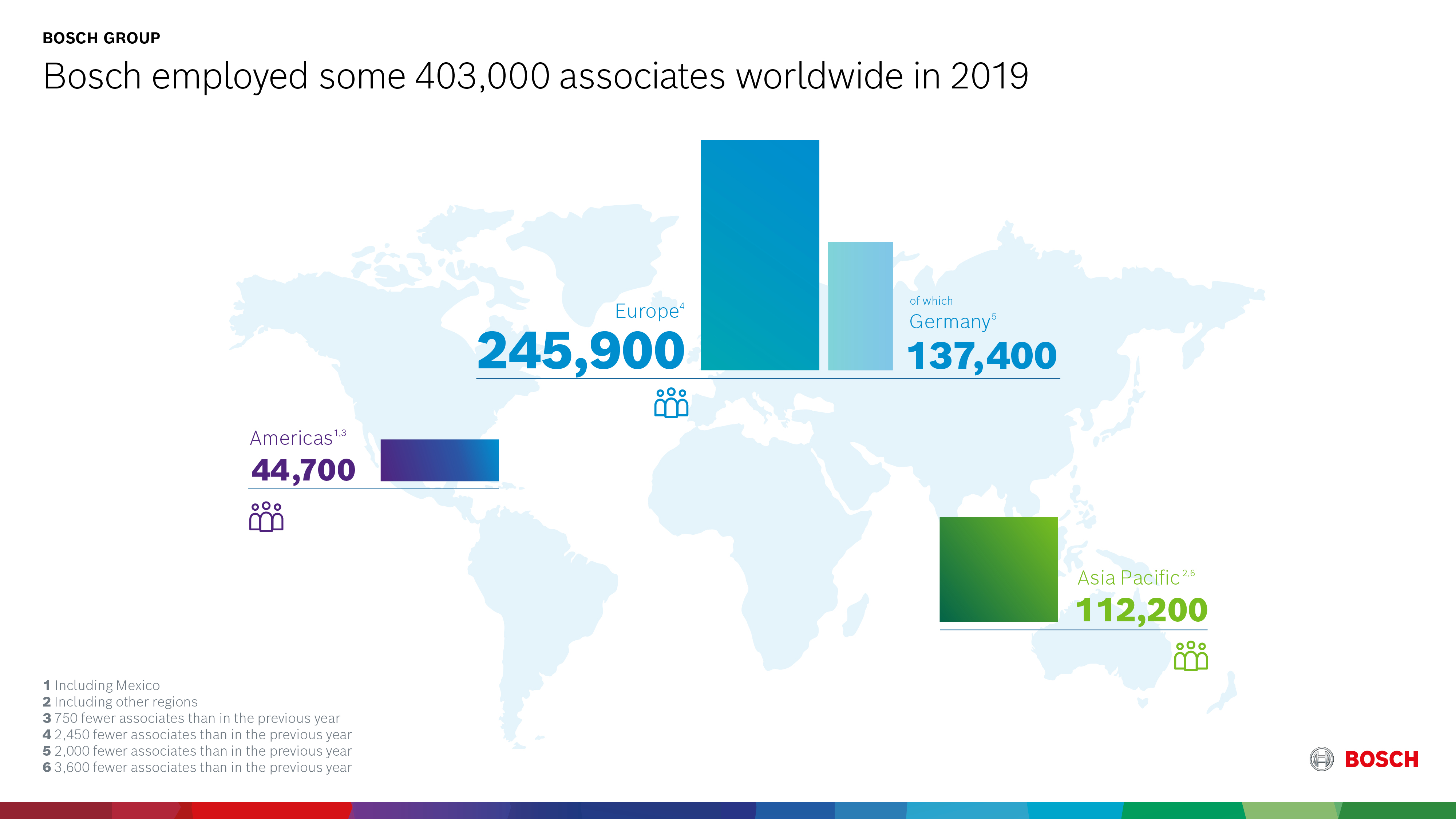

A global workforce of some 403,000 associates

Worldwide, the Bosch Group employed some 403,000 associates as of December 31, 2019. Headcount fell by 6,800, or 1.7 percent, with the major changes occurring in China and Germany.

Outlook for 2020: strengthening profitability despite the weak global economy

Bosch expects the global economy to grow just 2.0 percent in 2020. “In the face of continued economic weakness, global growth will slow down further,” Asenkerschbaumer said. In particular, important core industries such as automotive and machinery production are set to decline. Moreover, the trade situation between the United States and China, as well as the impending Brexit, are causing forecasts to cloud over. In view of overcapacity in the automotive industry and changes to the mix of powertrain technologies, Bosch is continuing to review its cost structures. Where necessary, personnel adjustments will be made in a socially acceptable manner. Asenkerschbaumer continued: “We expect a very challenging year for Bosch as well, in which we will work rigorously on our profitability.” A high level of profitability is essential if Bosch is to be able to make significant upfront investments in technologies of future importance and in the transformation of the company.

1Based on internal accounting.