In addition to the weak growth of the global economy, the Bosch Group’s business development was adversely affected by the fact that growth markets such as electromobility developed much more slowly than expected. A lack of sales in these areas and the accompanying underutilized capacity, as well as continued high upfront expenditure for future technologies and provisions for necessary strategic adjustments, had a negative impact on result. Despite all the challenges, Bosch continues to rigorously pursue its ambitious business goals: by 2030, the company aims to be among the leading suppliers in its areas of business in key markets. Moreover, the company is striving for average annual growth of between 6 and 8 percent, with a margin of at least 7 percent.

Growth strategy: portfolio management for greater business opportunities

In the past fiscal year, Bosch systematically implemented its Strategy 2030 and reached important milestones. One of these is the planned acquisition of the HVAC business of Johnson Controls and Hitachi, a deal worth around 8 billion U.S. dollars. By purchasing this business, Bosch intends to expand its presence in growth markets such as the U.S. and Asia. “Despite the current headwinds, we’re rigorously pursuing our growth strategy and will continue to resolutely drive forward technologies crucial for tomorrow’s world,” Hartung said. With the successful sale of large parts of its Building Technologies division’s product business for security and communications technology, Bosch will focus on the systems integration business in the future and continue to grow. With these moves, the company aims to achieve a better balance among its business sectors, improve its robustness, and make its portfolio viable for the future.

Technologies of the future: innovation creating solutions “Invented for life”

To achieve its growth targets, Bosch is driving innovation in areas of future importance. “Electromobility, hydrogen, and sustainable technologies remain a growth business and the focus of our innovations,” said Hartung, referring to the ongoing challenge of climate change. He gave the example of a cryogenic pump that Bosch is currently testing in the U.S., which compresses up to 600 kilograms of liquid hydrogen per hour. In just 10 minutes, such a pump will allow trucks to fill up with enough hydrogen for the next 1,000 kilometers. Bosch is also leading the way in home appliances. Just a few weeks from now, it will debut an energy-efficient built-in XXL fridge-freezer which will be the world’s first home appliance capable of manufacturer-independent connectivity via the new Matter standard. Around 5,000 AI experts at Bosch are working on making AI suitable for everyday use, such as a new AI-assisted emergency call service that allows elevator users to request help in their native language via simultaneous translation, but doesn’t require the retrofitting of elevators.

Digital solutions: artificial intelligence boosting core business

Intelligent software and digital services have now become an important pillar for Bosch’s core business. “We’re increasingly using AI in our own processes, improving quality and productivity in both our plants and our offices,” Hartung said. “AI has also become an integral part of our products and solutions.” Bosch expects to generate sales of more than 6 billion euros with software and services by the beginning of the next decade, two-thirds of this in the Mobility business sector. “At Bosch, AI has been playing an important role in assisted and automated driving for years now,” Hartung said. “But it’s not only in AI that we’re taking software-defined mobility forward, and this makes Bosch an ideal partner for the world’s major tech players.” One example is the system solution Vehicle Motion Management. Among other things, this enables brake-by-wire braking systems, in which an electronic brake pedal operates without a mechanical connection.

Economic policy: competitiveness for a strong Europe

Bosch is looking to new policy frameworks in Germany and the EU to stimulate growth. According to Hartung, action is needed to strengthen their competitiveness and attractiveness as places to do business. “A strong EU consists of fewer regulations and more investment as well as fewer barriers and more market liberalization,” he said. With a view to energy prices, bureaucracy, and a lack of investment in infrastructure in Germany, the company’s home market, Hartung hopes to see a quick move from talk to action after the country’s upcoming elections. “Anything that makes doing business easier is a step in the right direction,” he said. “Then Germany and Europe can be among the world’s economic and technological frontrunners in the future as well.” As before, Bosch wants to do its part here: in the coming year, roughly 40 percent of the company’s global investments will continue to go to its German locations.

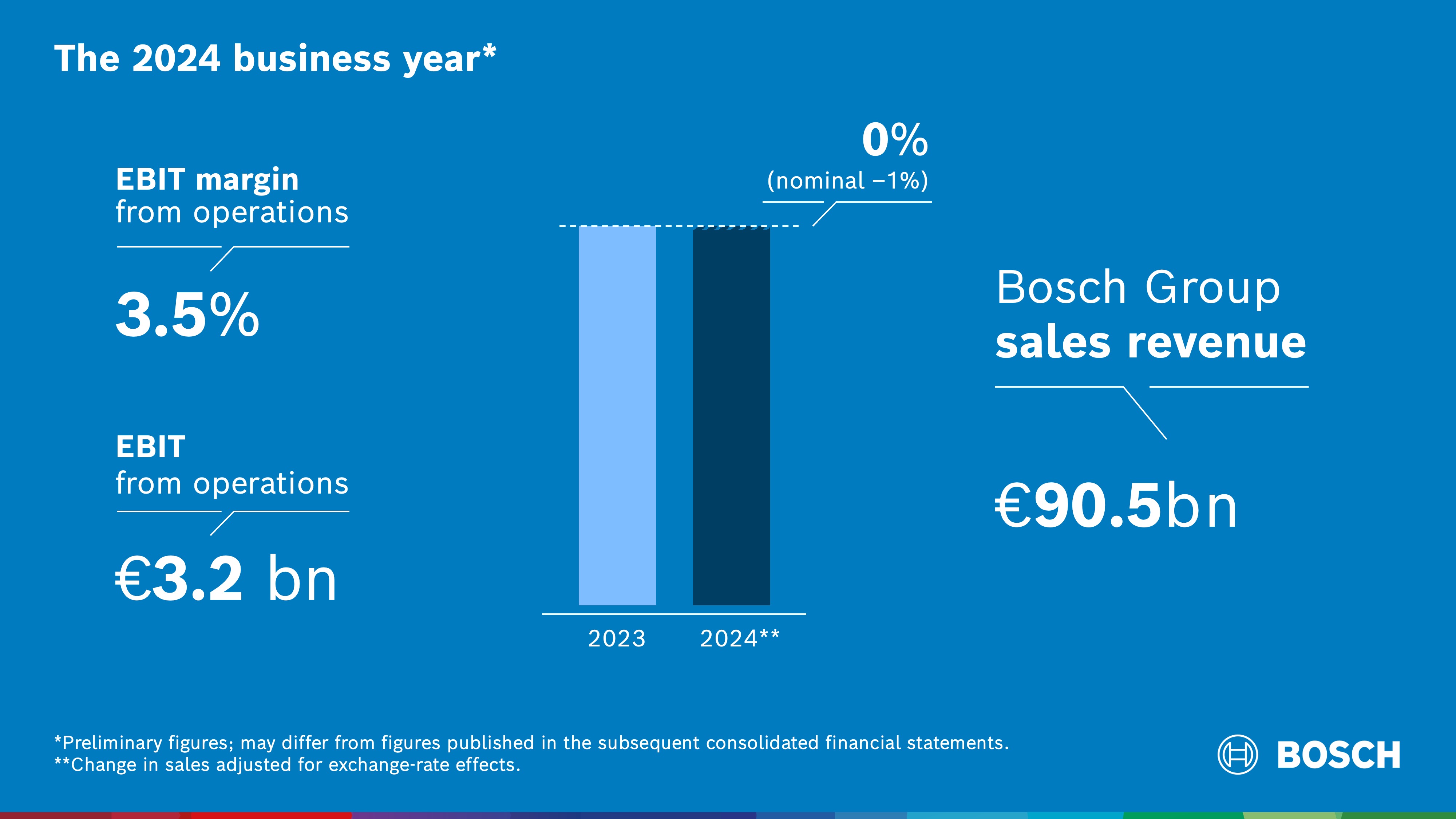

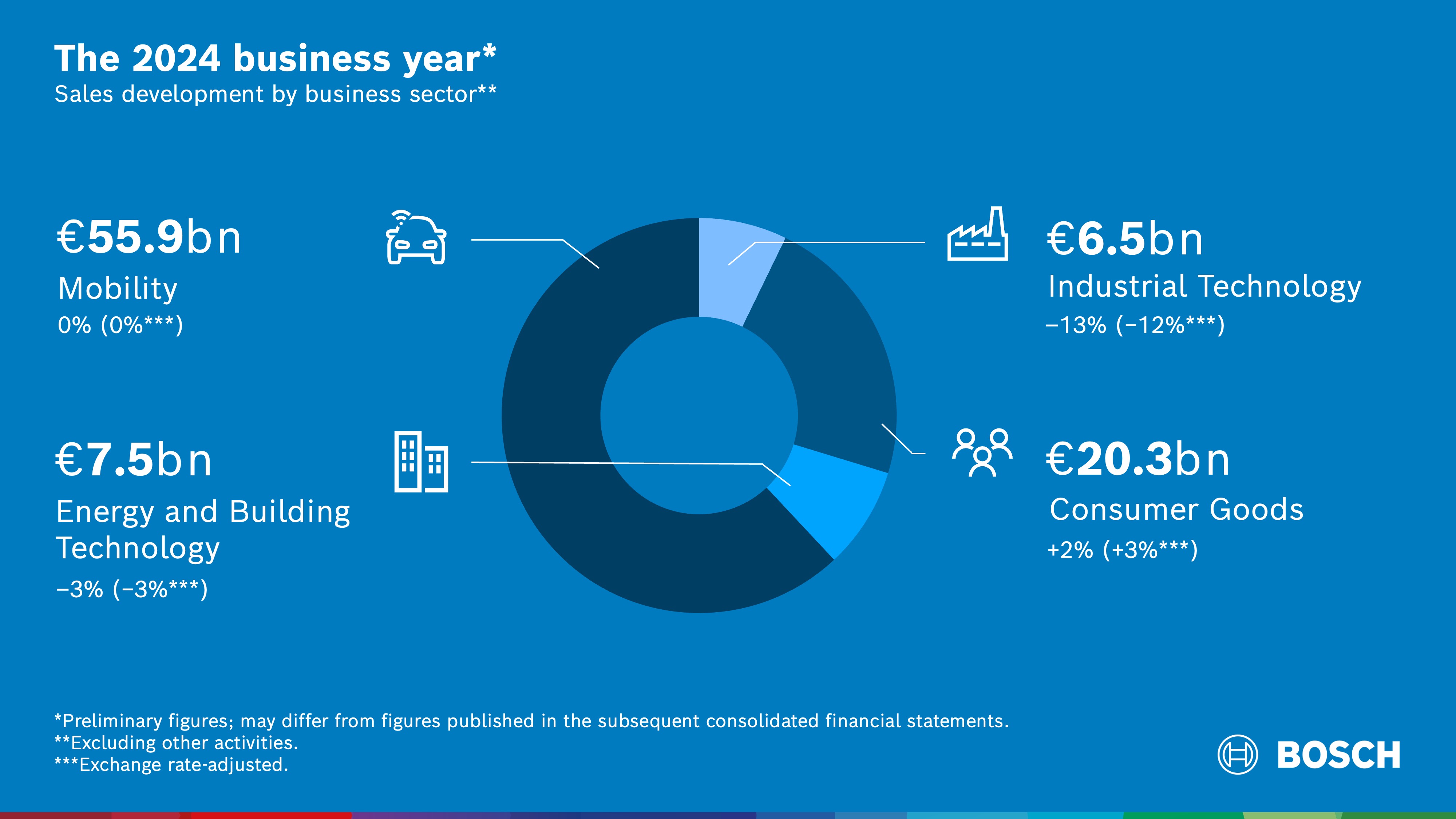

Business developments in 2024: market developments affecting business sectors’ sales

The sales figures for Bosch’s business sectors clearly reflect the general market trend. “Overall, 2024 was an outlier, with all our focus markets performing poorly at the same time,” said Markus Forschner, member of the board of management and chief financial officer of Robert Bosch GmbH. With sales revenue of 55.9 billion euros, the Mobility business sector roughly reached the previous year’s level. Despite the declining market, sales revenue remained virtually unchanged after adjusting for exchange-rate effects. In the Industrial Technology business sector, sales revenue reached 6.5 billion euros, which is 13 percent less than in the previous year in nominal terms, or minus 12 percent after adjusting for exchange-rate effects. The weak mechanical engineering sector hit the main markets of Europe, China, and the U.S. particularly hard. In the Consumer Goods business sector, sales revenue grew a nominal 2 percent to 20.3 billion euros. Adjusted for exchange-rate effects, this was in fact 3 percent higher than in the previous year. This means that Bosch is again growing in the consumer goods business – for the first time since the drop in demand at the end of the coronavirus pandemic. Sales revenue in the Energy and Building Technology business sector amounted to 7.5 billion euros. This corresponds to a decline of 3 percent, both in nominal terms and after adjusting for exchange-rate effects. This was mainly due to the gloomy sentiment in the European heating market.

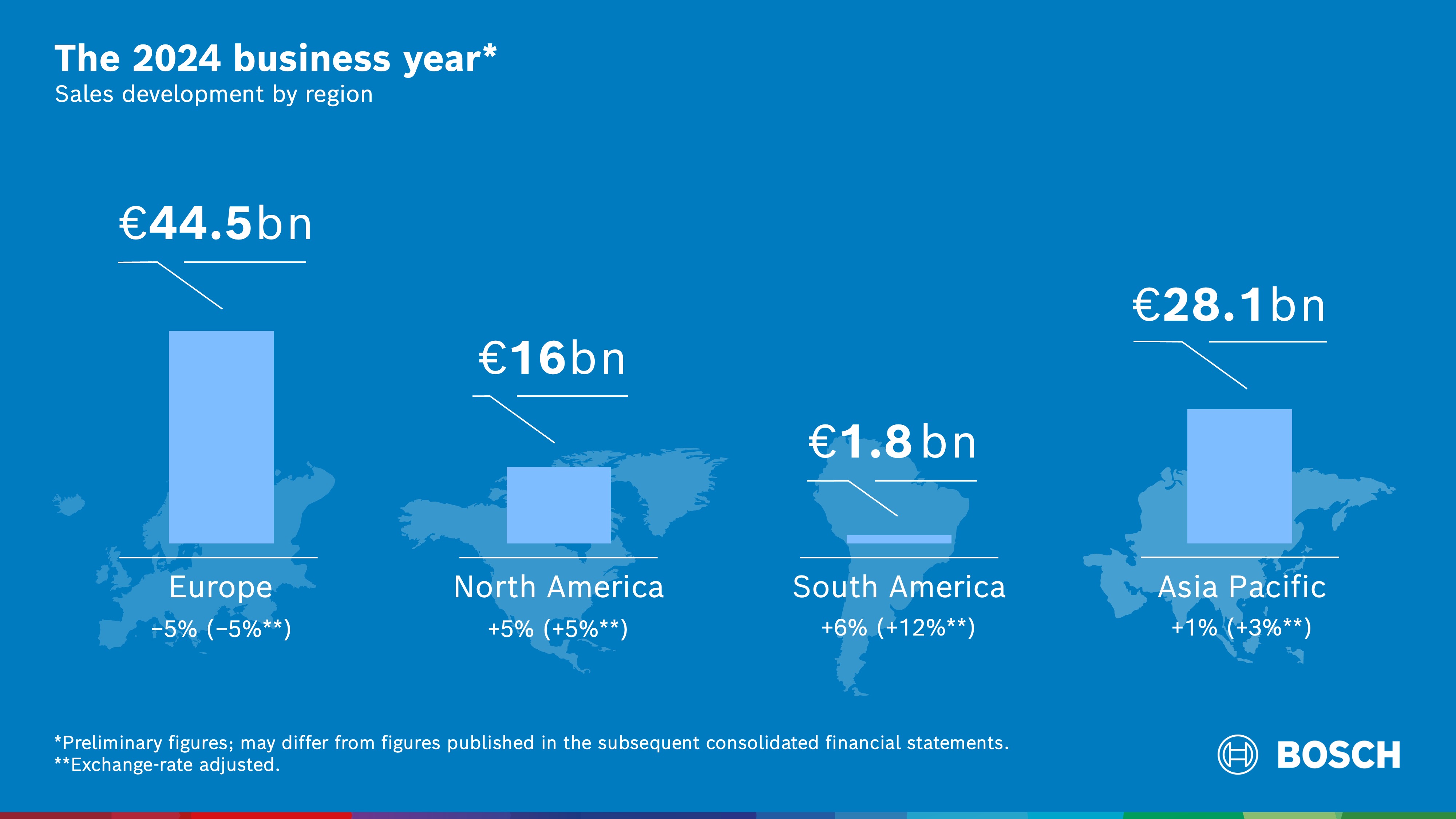

Business developments in 2024: subdued regional sales development

In addition to market developments, the economic situation impacted the regional development of sales revenue to varying degrees. “Our European business was particularly affected by the economic situation,” Forschner explained. Sales revenue in Europe totaled 44.5 billion euros, which represents a year-on-year decrease of 5 percent in nominal terms and after adjusting for exchange-rate effects. Developments in North America and China meant that sales revenue growth in the Americas and Asia Pacific was also on the subdued side. In North America, sales revenue grew by 5 percent to 16 billion euros. Sales revenue in South America totaled 1.8 billion euros. This is a nominal increase of 6 percent, or an exchange rate-adjusted 12 percent. In Asia Pacific, sales revenue grew to 28.1 billion euros. Nominal growth was 1 percent, or 3 percent after adjusting for exchange-rate effects.

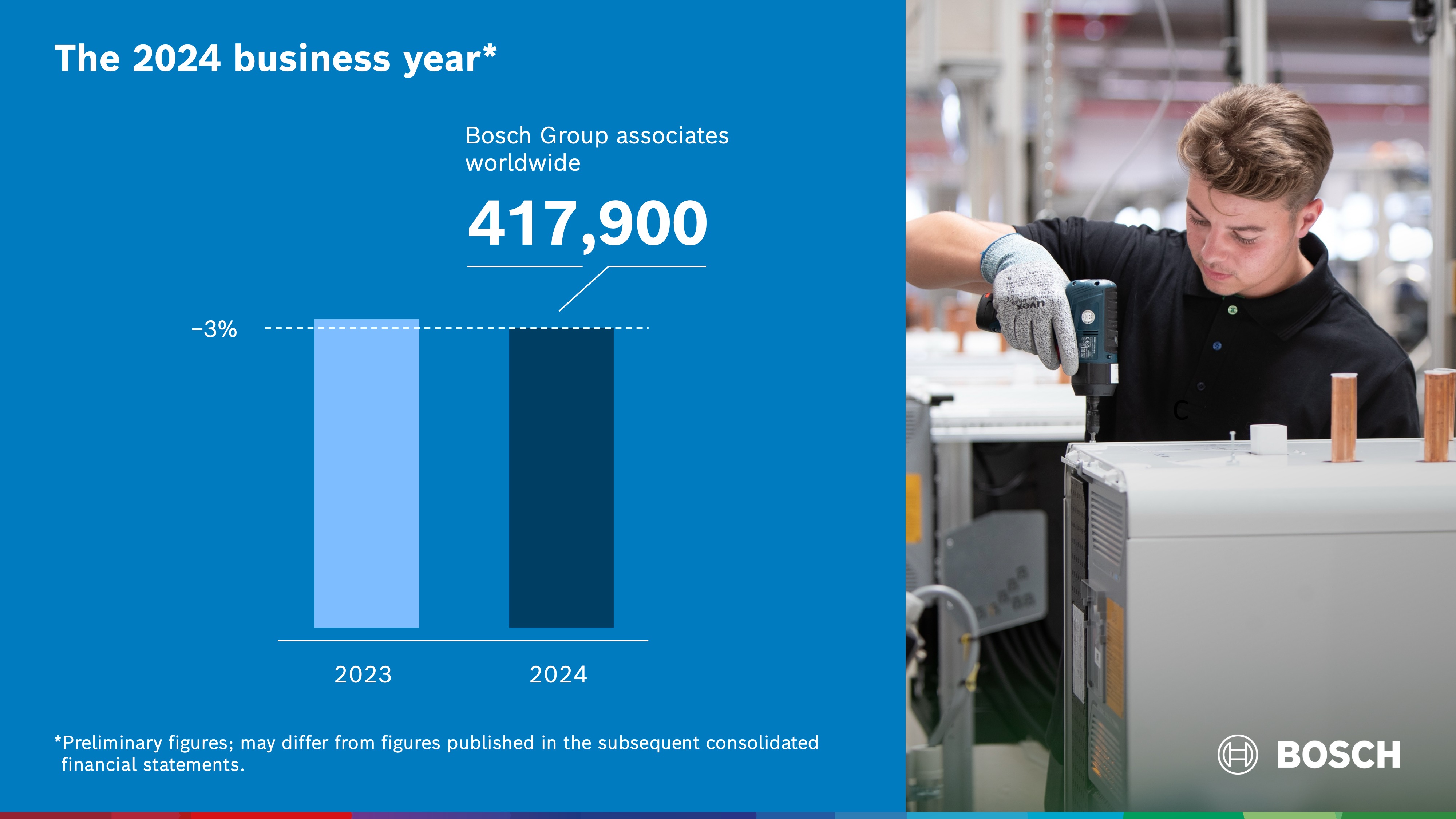

Headcount development in 2024: reduced personnel requirements becoming apparent

As of December 31, 2024, the Bosch Group employed some 417,900 associates worldwide – this is nearly 3 percent lower than the previous year (-11,500). Significant regional changes were seen in Europe and Asia. In Germany as well, headcount fell by around 3 percent (-4,400) to just over 129,800.

Outlook for 2025: weak economy to put greater pressure on costs

In the current year as well, the Bosch Group expects a highly challenging environment. “Worldwide, we anticipate that growth will remain only moderate,” Forschner said. “We don’t expect the global economy to pick up again before 2026.” As things stand, Bosch assumes that the economy will grow by just 2½ percent in 2025. To implement its growth strategy, the company remains focused on its financial targets. “Even in the face of persistently adverse conditions, we want to further improve our sales and result in the 2025 fiscal year,” Forschner said. In his view, only profitable growth will enable the company to continue its strong and meaningful development. Accordingly, Bosch aims to achieve its target margin of 7 percent by 2026. The objective is to further increase competitiveness at all levels – from attractive products and acceptable costs to suitable structures for a forward-looking portfolio. “Sensible savings and focused investments ensure that we have the necessary room for maneuver,” Forschner said. But he cautioned that this will not be easy. Such a plan will require great effort, and does not rule out painful decisions.

1 Rounded figures, may differ from figures published in the subsequent consolidated financial statements.